irs.gov unemployment tax refund status

The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state unemployment. Please see our latest update on In-person conferences.

Fury As Major Tax Refunds Are Delayed For Millions Of Americans Because Irs Staffers Are Working From Home

See How to File for options including IRS Free.

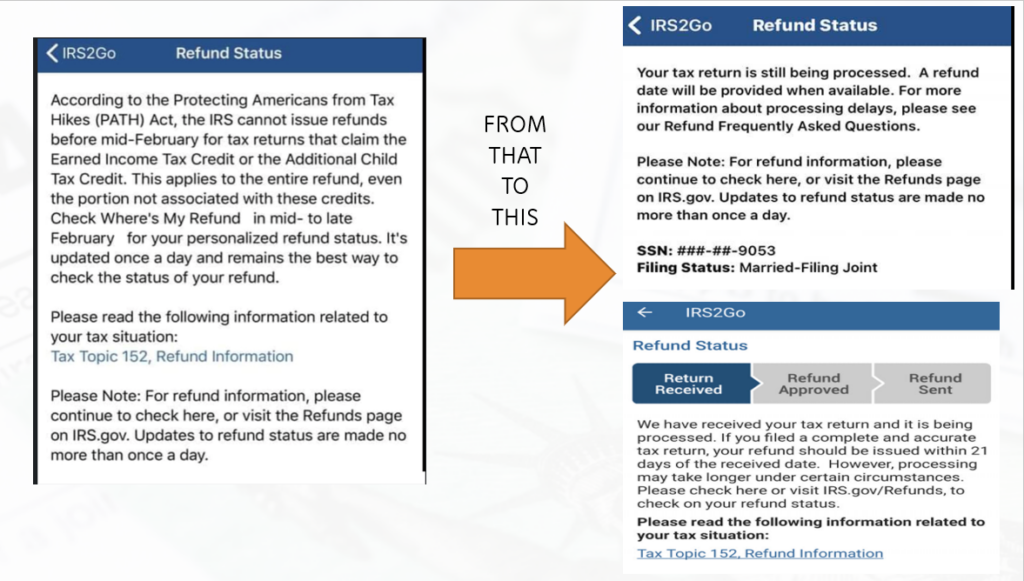

. Using the IRS Wheres My Refund tool Viewing your IRS account information Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. Coronavirus COVID-19 Impact on Appeals Cases. The tool tracks your refunds progress through 3 stages.

We appreciate your patience and understanding during this time. The IRS will continue to send refunds until all identified tax returns have been reviewed and adjusted. The notice is informing you that we changed your tax return to correct your unemployment compensation because of recent changes in tax laws rulings or regulations and as a result youll receive a refund youll have a reduced.

- One of IRSs most popular online features-gives you information about your federal income tax refund. How long it normally takes to receive a refund. See How Long It Could Take Your 2021 Tax Refund.

Some tax returns need extra review for accuracy completeness and to protect taxpayers from fraud and identity theft. Angela langcnet since may the irs has been making adjustments on 2020 tax. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

Includes a form 8379 injured spouse allocation which could take up to 14 weeks to process. Certifying for unemployment insurance benefits is a critical step to receive your benefit payments. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

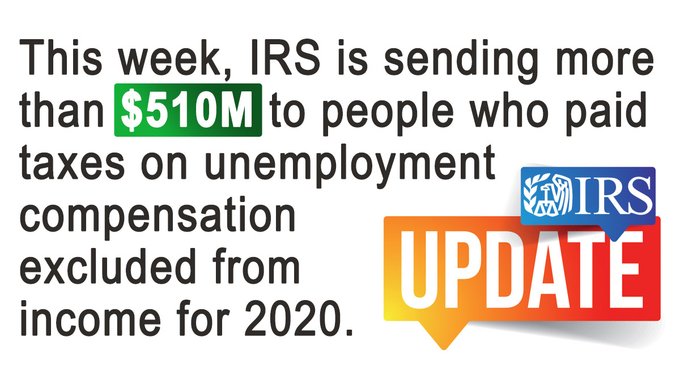

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. IR-2021-71 March 31 2021 WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

In order to use this application your browser must be configured to accept session cookies. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit.

For eligible taxpayers this could result in a refund a. The tool is updated once a day usually overnight and gives taxpayers a projected refund issuance date. Unemployment tax refunds are delayed well into 2022 The IRS issued 117 million of these special refunds totaling 144 billion.

In the latest batch of refunds announced in November however the average was 1189. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable amount of unemployment compensation and tax.

The tool provides the refund date as soon as the IRS processes your tax return and. Ad Learn How Long It Could Take Your 2021 Tax Refund. Once you register and create an account file for unemployment online with UI Online SM.

IRS continues unemployment compensation adjustments prepares another 15 million refunds IR-2021-159 July 28 2021 WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. Irsgov unemployment tax refund status. The latter will vary between households depending on overall income your tax bracket and how much of your earnings came from the benefits.

If your mailing address is 1234 Main Street the numbers are 1234. IR-2021-159 July 28 2021 The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. The unemployment tax refunds are determined by the employees earnings the length of time on unemployment and the states maximum benefit amount.

The IRS Independent Office of Appeals is here to resolve disputes without litigation in a. Check For the Latest Updates and Resources Throughout The Tax Season. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

The average pay for an unemployment claim is 4200 but it can cost up to 12000 or more. Up to 3 weeks. If you have questions about your case contact your assigned Appeals Office by phone.

Up to 3 months. You get personalized refund information based on the processing of your tax return. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

In late may the irs started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax break.

You certify for benefits by providing us your eligibility every two weeks. In general all unemployment compensation is taxable in the tax year it is received. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

Please ensure that support for session cookies is enabled in your browser. You should receive a Form 1099-G showing in box 1 the total unemployment compensation paid to you. Congress passed the American Rescue Plan Act on Mar 11 2021 which President Joe Biden signed.

How To Find Your Irs Tax Refund Status H R Block Newsroom

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Heartbreaking Stories Emerge As Millions Await Tax Refunds Or Stimulus Payments From Irs Fingerlakes1 Com

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

Irs Tax Forms What Is Form 1040 Sr U S Tax Return For Seniors Marca

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 Chicago

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Tax Preparation Checklist Tax Preparation Income Tax Preparation Tax Prep

Irs Letter 707c Refund Or Return Delayed In Processing Refund Forthcoming H R Block

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Faqs On Tax Returns And The Coronavirus

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time