vermont sales tax exemptions

974126 In mixed-use buildings both residential and commercial the portion of fuel used for residential purposes is exempt but the portion for commercial purposes is subject to sales tax. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0092 for a total of 6092 when combined with the state sales tax.

Heating oil gas and other fuels used in a residence for all domestic use including heating 32 VSA.

. Local jurisdictions can impose additional sales taxes of 1. In some states clothing is completely tax-exempt while in others there are luxury thresholds at which clothing. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

Consumers should submit Form S-3F and. The exemption reduces the appraised value of the home prior to the assessment of taxes. For other Vermont sales tax exemption certificates go here.

A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the organization has been granted exemption status from Vermont Sales and Use Tax as having 501 c 3 status. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000.

Form S3 Resale and Exempt Organization Certificate of Exemption is not. Vermont has 19 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Retail sales and use of the following shall be exempt from the tax on retail sales imposed under section 9771 of this title and the use tax imposed under section 9773 of this title.

The Sales Tax Permit allows a business to sell and collect sales tax from taxable products and services in the state while the Resale Certificate allows the retailer to make tax-exempt purchases for products they intend to resell. You can download a PDF of the Vermont Streamlined Sales Tax Certificate of Exemption Form SST on this page. The range of total sales tax rates within the state of Vermont is between 6 and 7.

The maximum local tax rate allowed by Vermont law is 1. 974114 15 16 24 Form S-3M ˇ ˆ SELLER ˆ ˇ. S53 As Passed by Senate House Amendment Senate Strike-All Amendment SUMMARY 3172022 VT LEG 360480 v5 Summary of Amendments S53 As Passed by Senate Created a sales and use tax exemption for feminine hygiene products effective July 1.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. The tax also applies to sales of dyed diesel sold in bulk if the fuel is for non-propulsion use. Testimony from the Tax Department identified other inconsistencies and inequities regarding tax code for inputs to grow food.

In Vermont certain items may be exempt from the. What is Exempt From Sales Tax In Vermont. The state of Vermont levies a 6 state sales tax on the retail sale lease or rental of most goods and some services.

Provide vendor with completed Sales Tax Exempt Purchaser Certificate Form ST-5 PDF and copy of Form ST-2 Certificate of Exemption PDF. How to use sales tax exemption certificates in Vermont. Exempt from sales tax on purchases of tangible personal property and meals not rooms.

Vermont has a statewide sales tax rate of 6 which has been in place since 1969. Sales tax on clothes varies significantly between states with different tax rates tax holidays and general regulations on the level at which clothing is taxed. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax Agreement.

What is exempt from sales tax in Vermont. The compost tax issue emerged when changes to the tax code in 2007 omitted compost and planting mixes from the list of products exempt from sales tax when used in farming. Clothing Tax A State-by-State Guide.

9741 9741. Please note that Vermont may have specific restrictions on. The Vermont Sales Tax is applied to commercial sales of heating fuel.

The veterans town provides a 20000 exemption. 9741 13 with the exception of soft drinks. FOOD FOOD PRODUCTS AND BEVERAGES TAXABLE Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

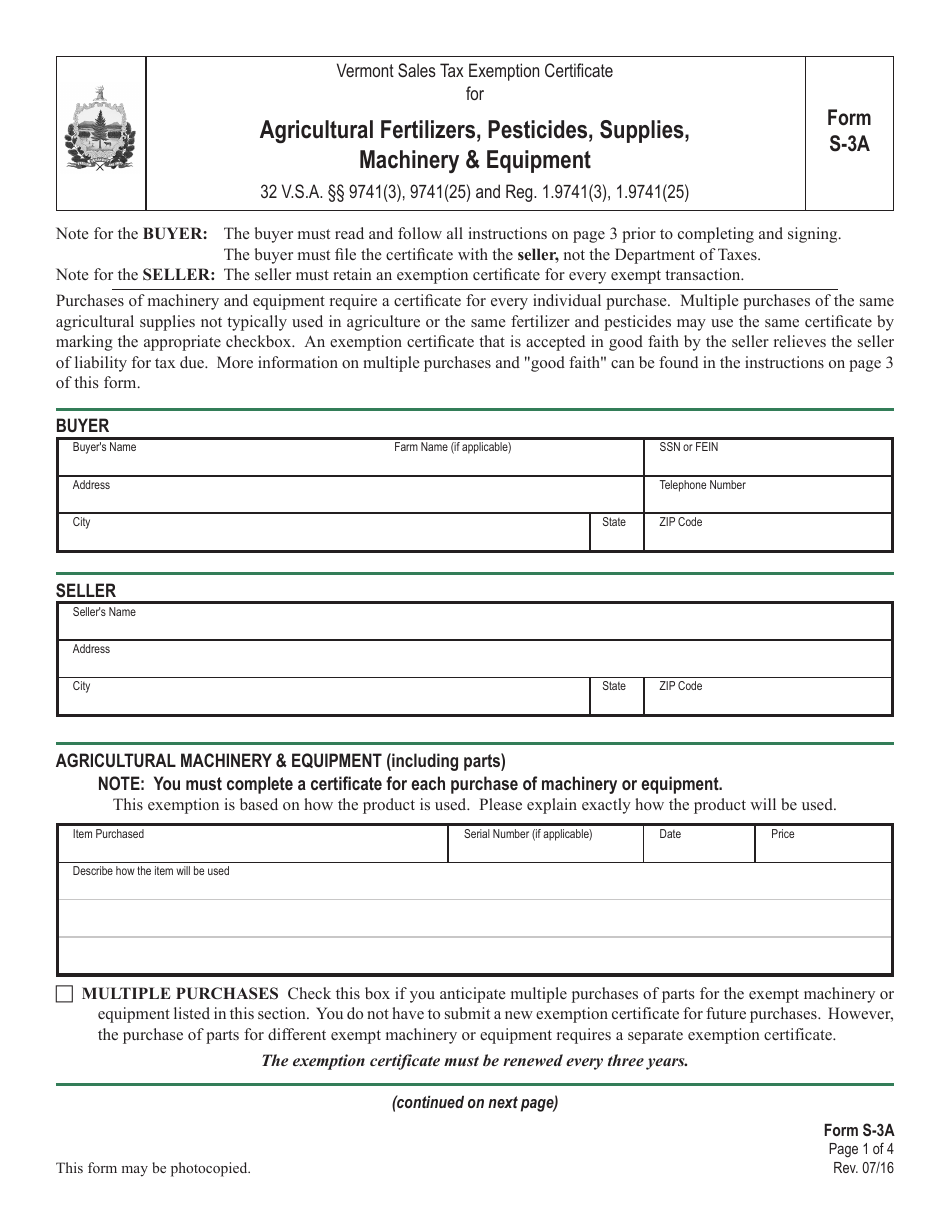

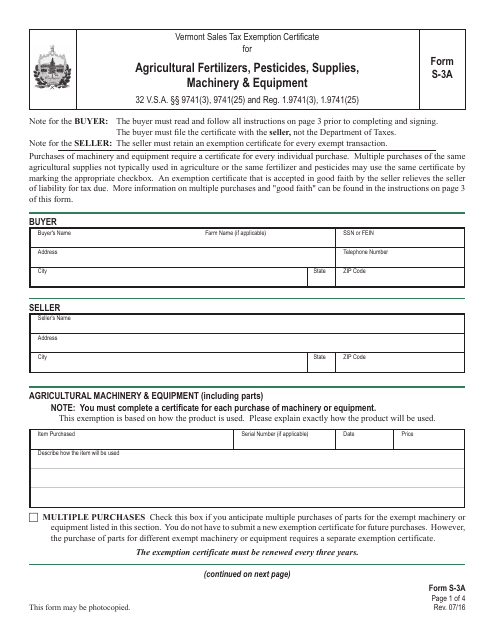

Business and Corporate Exemption Sales and Use Tax. 10 rows Vermont Sales Tax Exemption Certificate for Agricultural Fertilizers Pesticides Machinery. 31 rows Sales Tax Exemptions in Vermont.

FOOD FOOD PRODUCTS AND BEVERAGES TAXABLE Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. What is exempt from sales tax in Vermont. ˇ ˇ ˇ.

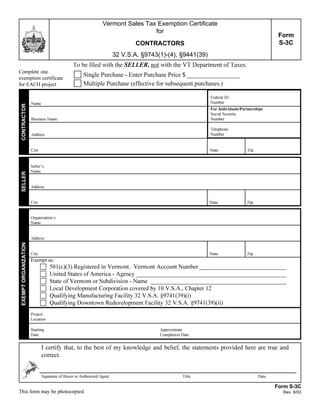

Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Vermont sales tax. An eligible veteran lives in a home valued at 200000.

ˇ BUYER ˇ ˇ ˆ ˇ ˇ ˇ ˇ ˇ ˇ ˇ ˆ ˆ EXEMPTION CLAIMED ˇ ˇ ˇ ˆ. Types of fuels exempt from sales tax based on use. 1 Sales not within the taxing power of this State under the Constitution of the United States.

Wednesday March 16 2022 - 1200. Vermont Sales Tax Exemption Certificate for MANUFACTURING PUBLISHING RESEARCH DEVELOPMENT or PACKAGING 32 VSA. 974113 with the exception of soft drinks.

Published March 21 2022. S-3pdf 8943 KB File Format. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax.

There are exemptions from the Sales Tax for dyed diesel used for manufacturing forestry and agricultural purposes.

Vt Vs Svt With Aberrant Conduction Conduction Jitra Algorithm

Form S 3a Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Agricultural Fertilizers Pesticides Supplies Machinery Equipment Vermont Templateroller

Form S 3a Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Agricultural Fertilizers Pesticides Supplies Machinery Equipment Vermont Templateroller

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting

Exemptions From The Vermont Sales Tax

Vt Vs Svt With Aberrant Conduction Conduction Jitra Algorithm

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

State By State Guide To Taxes On Retirees Retirement Tax States

Pin By Phyllis Levine On Beauty In 2021 Massage Therapy Massage Therapist Acupressure

Vermont Tax Exempt Forms Fill Out And Sign Printable Pdf Template Signnow

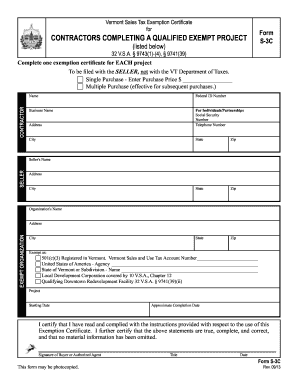

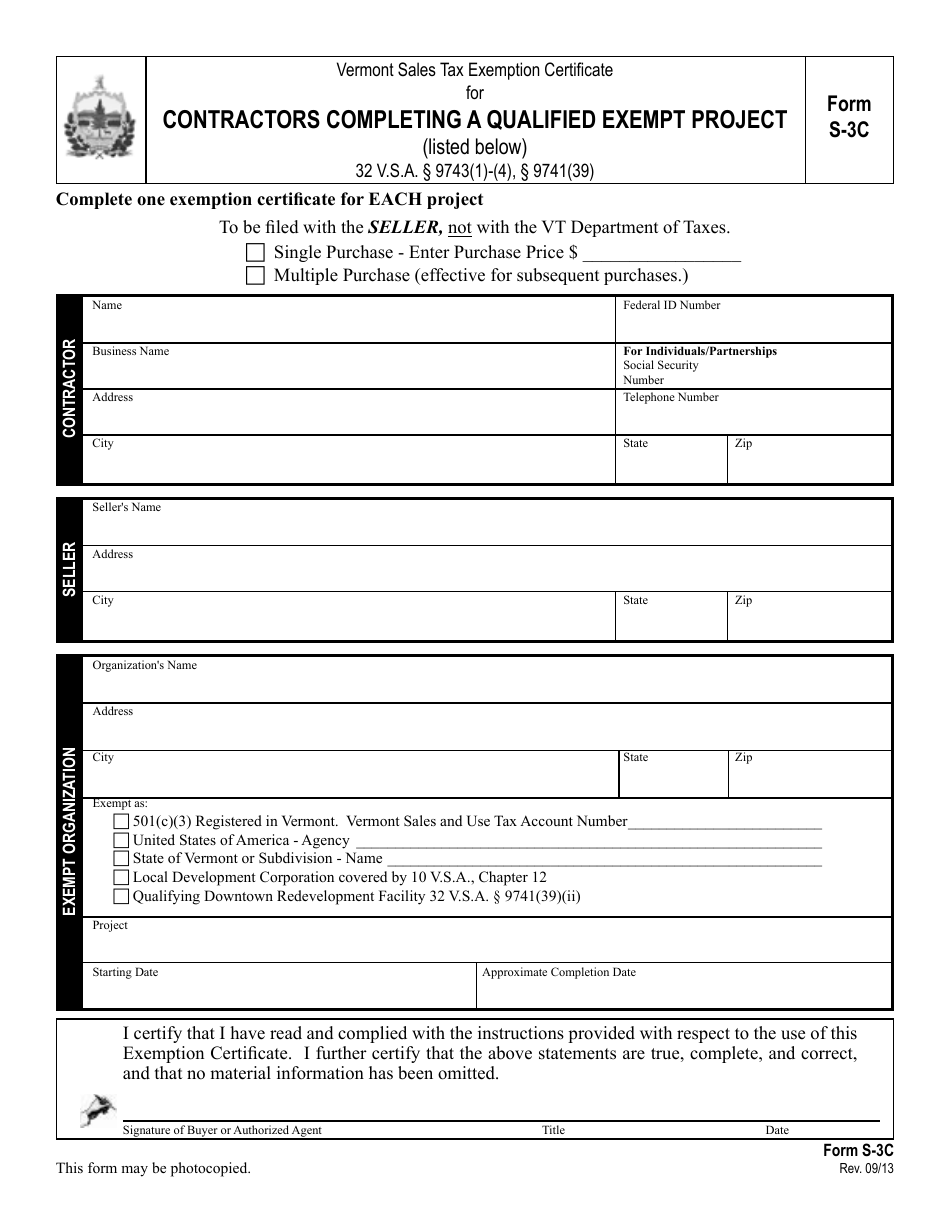

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

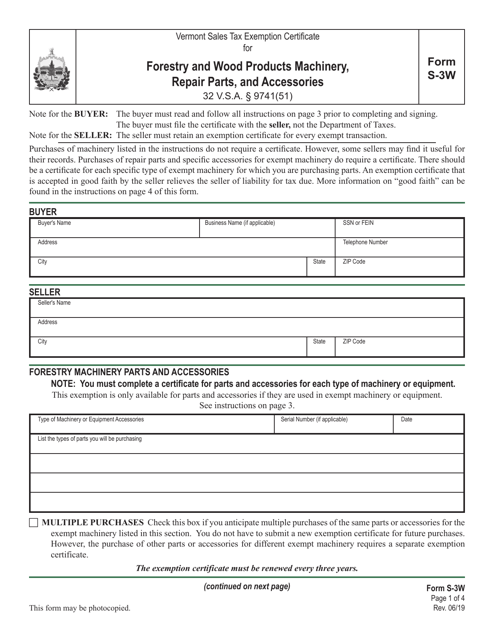

Form S 3w Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Forestry And Wood Products Machinery Repair Parts And Accessories Vermont Templateroller

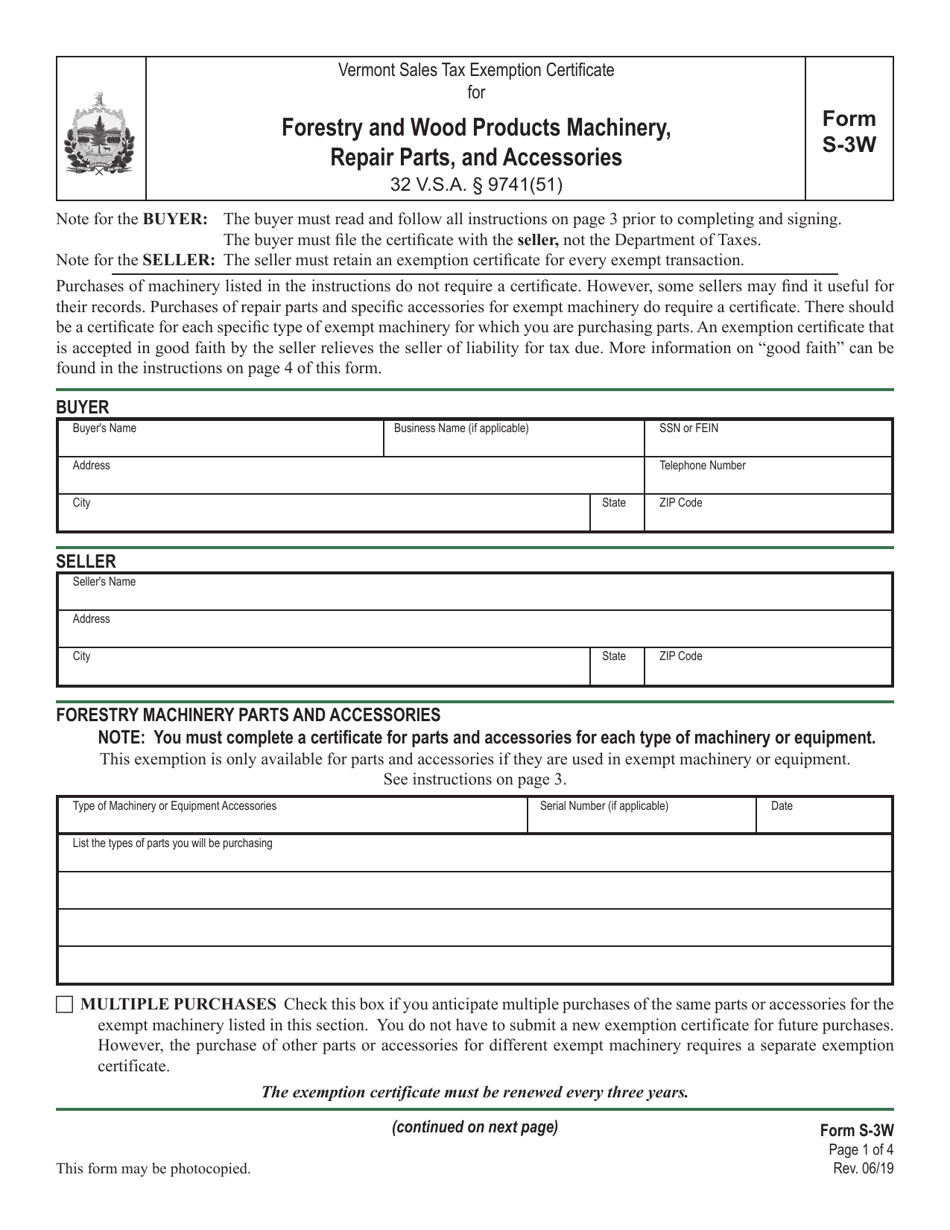

Form S 3w Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Forestry And Wood Products Machinery Repair Parts And Accessories Vermont Templateroller

Vermont Sales Tax Exemptions Sales Tax By State Agile Consulting